Breadcrumb

Divestment and Green Investments

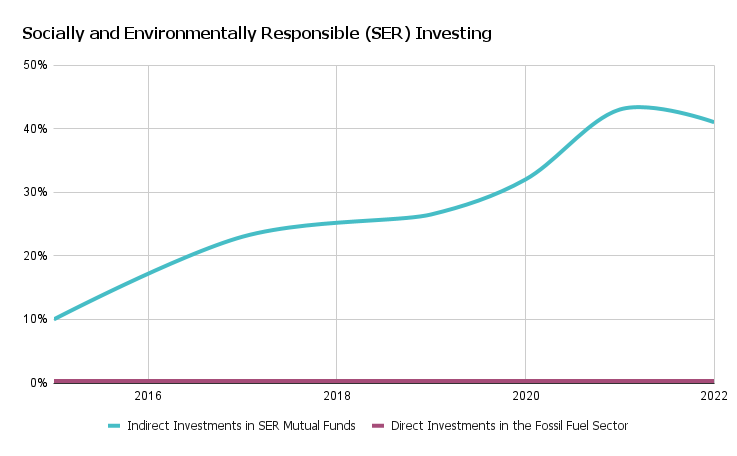

The Cal Poly Humboldt Foundation oversees and advises on all matters related to investments. In 2013, working with a group of students, the Foundation developed a strategy to divest from fossil fuels. Watch this video to learn more about that effort. Humboldt has eliminated all direct fossil fuel investments! Now, the Foundation is navigating the challenge of divesting from fossil fuels held in mutual funds and investing in socially and environmentally responsible (SER) mutual funds. Humboldt is one of a handful of universities in North America to have signed on to the United Nations Principles for Responsible Investment (UNPRI).

Goals

- Champion sustainability by realizing the interconnectedness of the environment, the economy and our society (Goal 3 of Resources Stewardship & Sustainability, Strategic Plan 2021-2026)

- Increase percentage of endowment invested in SER institutional mutual funds (Humboldt Investment Policy)

Status

The Humboldt Socially and Environmentally Responsible Investment Offset Policy (SEROP) drives investment and divestment activity. The Cal Poly Humboldt Foundation continues to abstain from any direct investment in Concerning Sectors (including fossil fuels) and to cut indirect mutual fund investments in Concerning Sectors, which include the fossil fuel industry as well as companies that support the fossil fuel industry. Furthermore, the Foundation has expanded its definition of socially concerning sectors to include aerospace and defense, alcohol, casinos and gambling, and tobacco.

Projects

- Abstain from further direct investments in fossil fuels and other Concerning Sectors (The Foundation) - Completed

- Invest in sectors with positive sustainability screens (The Foundation) - ongoing

- Divest from sectors with negative screens, including fossil fuels (The Foundation) - ongoing

- Monitor and report on the value of direct and indirect investments in SER organizations, projects or assets (The Foundation) - ongoing

Next Steps

- Conduct shareholder advocacy to encourage further investments in socially or environmentally responsible funds

- Continue active mechanism of sharing and receiving best practices from peer institutions about sustainable investments via Intentional Endowments Network

- Revisit proxy voting with Finance & Investment Committee

- File/re-file shareholder resolutions that address sustainability and submit letters about social and environmental sustainability to a companies holding Humboldt investments

- Consider adoption of AA1000 Stakeholder Engagement Standard

Learn More and Get Involved

- Learn more about the Humboldt Investment Pledge and its efforts to divest from fossil fuels

- Attend a meeting of the Finance and Investment Committee

Explore Sustainability Dashboard Categories

The Humboldt Sustainability Dashboard makes visible our progress towards meeting our sustainability goals, by featuring updated metrics for key sustainability performance areas, along with project descriptions, next steps and information on how you can learn more and get involved. Click through the sustainability categories and join the movement!

This dashboard is brought to you by the Humboldt Advisory Committee on Sustainability (HACS), a group of students, faculty and staff who believe that continual improvement in sustainability can be achieved with transparency and accountability.