Breadcrumb

Payment Requests

In order to access your RSO's funds, you will first need to make sure that your RSO has a current Financial Agreement on file. If there have been any changes to the RSO's president, treasurer, or advisor, a new Financial Agreement will need to be filed before any payment requests can be processed.

Steps to Submit a Payment Request

- Fill out the Payment Request Form and obtain the required signatures from your RSO's Advisor and either the President or Treasurer.

- Tape your original itemized receipt to a blank piece of paper.

Receipts that are lost, not itemized, or missing essential information will require the submission of a Lost Receipt Memo - Submit any supplemental paperwork to Club Financial Services. See below

- Bring the signed form, receipts, and all necessary paperwork to the Club Financial Coordinator who will review your request. Incomplete forms cannot be accepted and will be returned. This includes missing receipts, invoices, or supplementary forms.

Reimbursements | Direct Payments |

| To a club member for purchasing supplies: | To a vendor for purchasing supplies and services: |

Members that submit receipts for a total under $300 may be eligible for same-day cash reimbursement. Reimbursements over $300 (including multiple requests for the same person) will be issued a check. Required paperwork:

| A check can be mailed directly to a vendor for supplies or services, to help club members from paying out-of-pocket. If a vendor has the option to pay online, the Club Financial Coordinator can use a ProCard to pay directly from the club's account. Required paperwork:

|

| To a club member for travel expenses: | To a Guest Lecturer: |

Club members must first receive Pre-Authorization from the Clubs & Activities Office before club funds can be utilized. Reimbursements may only be processed after the club's scheduled travel dates. Club members traveling by car have the option to rent a vehicle or use a member’s personal vehicle (please see the Clubs & Activities Travel Policy for the driving approval process). Clubs that choose to rent a car may only do so from Enterprise-Rent-A-Car. Clubs that use an alternative rental company cannot be reimbursed for the rental expense. Only Pre-Approved drivers may be reimbursed for gas expenses. Rental car gas receipts will be reimbursed at face value. Gas reimbursement for a personal car is based on mileage not exceeding the federal limit. Required paperwork:

| Payment for a Guest Lecturer's speaker fee is considered taxable income to the guest. A club also has the option to utilize its funds to reimburse a guest lecturer for their travel, which is not considered taxable income. Reimbursement for a guest lecturer's travel expenses follows the same rules and criteria as reimbursement for a student's travel expenses. (see left column) Required paperwork:

|

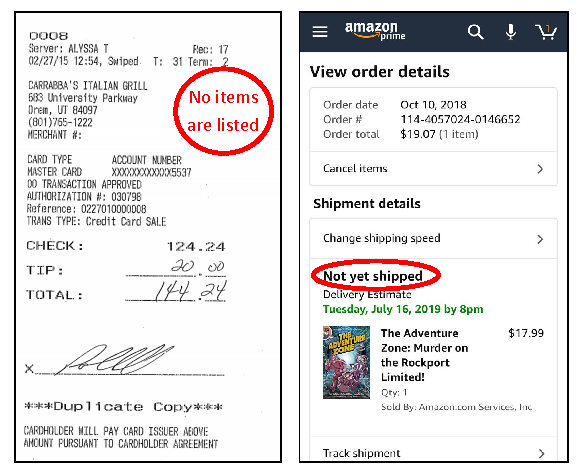

Identifying Original, Itemized Receipts

An original, itemized receipt must show the following

- Name of business/vendor

- Date

- Item(s) purchased

- Price of each bill

- The total amount of the bill

- Method of payment

- The order has shipped (online orders)

Unacceptable Receipts

These receipts are examples of unacceptable receipts. They are missing essential information needed to be considered an itemized receipt. If your receipt is missing any essential information above, you must submit a Lost Receipt Memo with your Payment Request Form.

Restrictions to Payment Requests

- Club funds may only be used to further the goal/purpose of the club. Payments and reimbursements are not permitted to be used for a member’s personal expenses.

- Payment Request Forms may only be submitted for expenses or services in the same fiscal year they were incurred. (July 1st - June 30th)

- Members are prohibited from using club funds to purchase any tobacco products, drugs, or alcohol.

- Tips or gratuity for meals can be reimbursed not to exceed 20% of the total bill.

- Payment Request Forms submitted for payment to a vendor (such as caterers, guest lecturer, DJ, etc), will be paid by check and are not eligible for same-day cash reimbursement.

- In the event a club’s advisor is inaccessible to sign a Payment Request Form, the designated “one-up” authority is the Director of Student Life.

- It is illegal in the State of California to receive a cash (or cash equivalent) reimbursement for a purchase made originally with Food Stamps/CalFresh Benefits/EBT credit. Doing so is considered fraud and may revoke one’s eligibility to receive such benefits.